AdRoll’s recent 2023 digital ad spend data reveals a major cost drop amid economic uncertainty. However, positive indicators point to a potential rebound heading into peak holiday seasons. We summarize the key insights and examine if similar patterns are playing out in Europe.

Key Takeaways from AdRoll’s H1 2023 Digital Ad Spend Analysis:

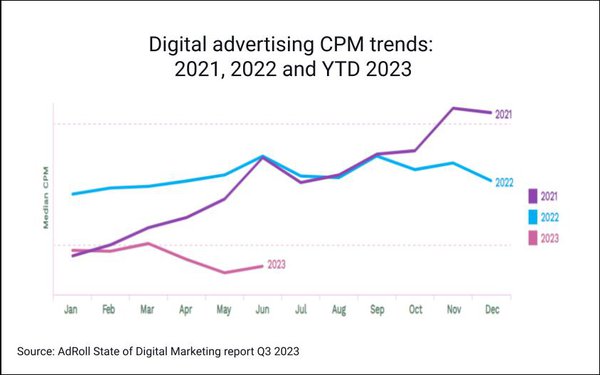

- Average CPMs dropped 49% year-over-year, extending Q1’s decline

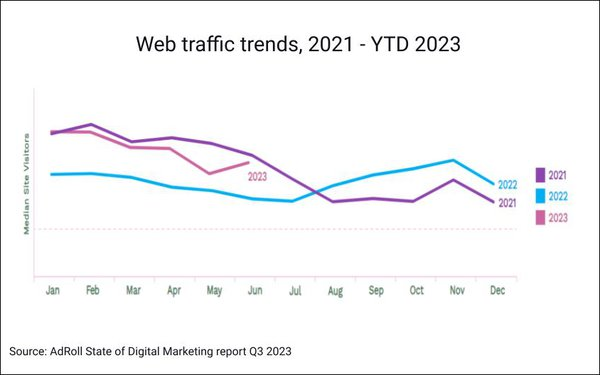

- But website traffic showed slight 8% gain versus 2022

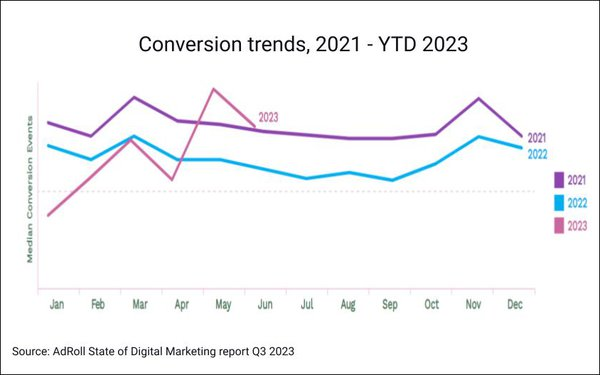

- Conversions increased 13% with big jumps in entertainment/hobbies

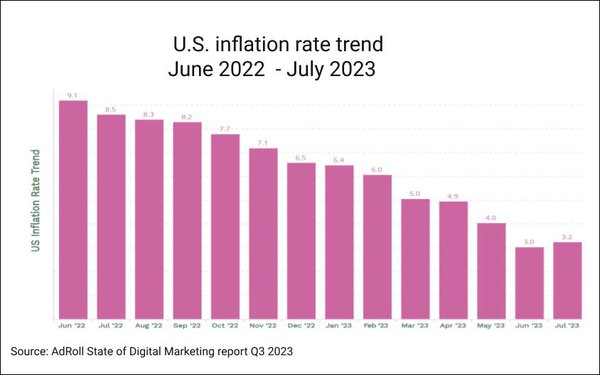

- Inflation reductions and sentiment gains suggest imminent CPM recovery

- Ad rebound likely approaching 2023 holiday shopping peak

CPM Trends Follow Macroeconomic Forces

AdRoll’s data on 2000 North American companies shows average CPMs down 49% in Q2 2023 after a 33% Q1 decline, reversing years of seasonal gains.

Yet website traffic grew slightly despite cost drops, hinting at ongoing engagement. More encouragingly, conversions rose 13% as consumers prioritized enriching purchases over big tickets.

The CPM declines mirror pullbacks in ad spend given economic caution. But falling inflation, rising sentiment, stock gains, and recession dodging point to recovery. Ad spending typically climbs in Q3 and peaks in Q4.

So the stage is set for a digital ad rebound approaching the projected 2023 holiday season. As Meta and analysts confirm, demand and CPMs could snap back rapidly.

Parsing the Differences in the EU Digital Ad Market

In the EU, 2022 digital ad spend grew 15%+. This slowed to single digits in 2023 on economic impacts cushioned by energy independence.

However, similar inflation spikes and dropping consumer confidence affected the EU ad market. CPM declines may be less dramatic than the 49% in North America. But pressures clearly impacted spend.

The push and pull means EU recovery may trail the US rebound. But analysts see growth returning in 2024 on pent-up demand. Fundamentals like lower inflation point to an expanding ad market.

So while severity differs, the data shows economic forces link to marketing budgets. Maintaining flexibility allows brands to optimize strategy.