Premium video publishers face constant tensions balancing adequate ad monetization versus optimizing viewer experience. New analysis from FreeWheel offers data points on evolving European premium video ad loads. We summarize the key findings and examine the greater challenges smaller OTT providers face in minimizing ad overload without sacrificing revenue.

Delivering an optimal ad load requires considering factors like ad length, pod size, placement frequency and how they impact retention. FreeWheel explored trends across European long-form, mid-form and short-form premium video. We analyze the insights including from a perspective of smaller player challenges.

Key Premium Video Ad Load Trends in Europe:

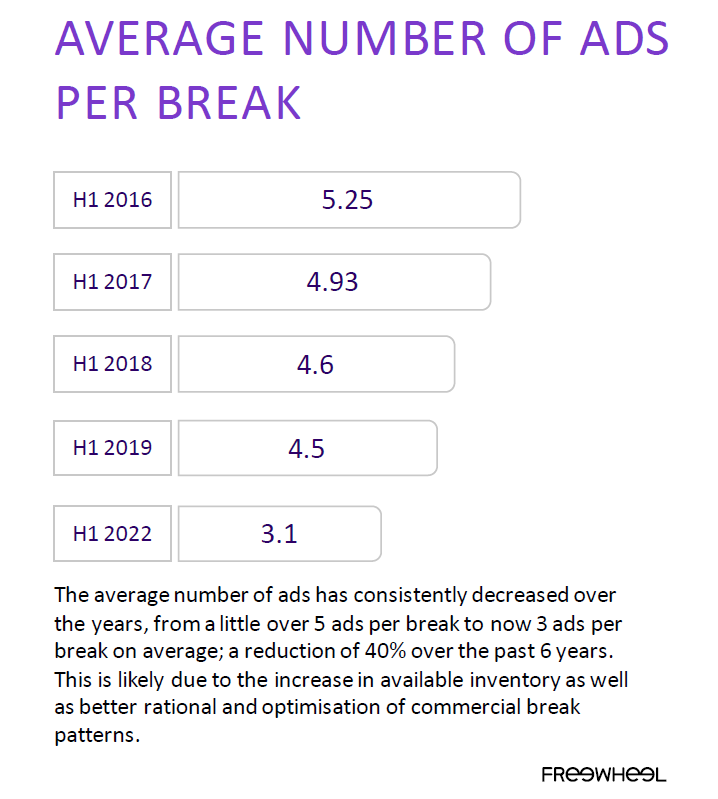

- Average ad pods decreased 40% since 2016, down to around 3 ads currently

- Mobile breaks run shorter to cater to usage patterns and attention span

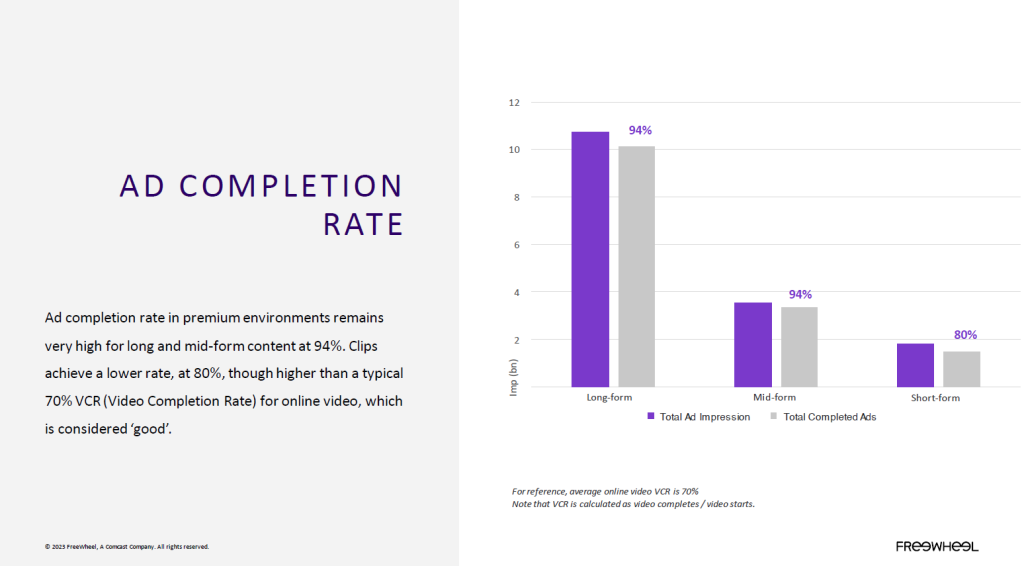

- Ad completion rates remain high for most content types

- But smaller providers likely require longer breaks to generate needed revenue

- Best practice is minimizing ad loads to avoid disengaging users

Reducing Ad Frequency and Duration Over Time

FreeWheel’s aggregated data reveals a major reduction in premium video ad loads in Europe since 2016. The average number of ads contained within ad pods has declined 40% over the past six years. Breaks now hold approximately three ads versus over five ads previously.

In addition, average ad pod durations have decreased over this period. On mobile devices, breaks run lighter still, with typically just one or two shorter 15-30 second ads to match usage behaviors and expectations.

This implies European premium video publishers are being judicious regarding ad loads and striving to strike an optimal balance between monetization and retention. With ad completion rates staying high for most content types, the vast majority of viewers see ads through to completion during premium streams and episodes.

Monetization Pressures for Smaller Premium Video Providers

However, smaller premium video providers on tighter budgets still face greater challenges balancing needed revenue generation and optimal user experience. Unlike major platforms, they cannot afford significantly ad-light streams.

Shorter, less frequent ad breaks reduce opportunities to generate sufficient revenues from their smaller viewership bases. But going beyond three to four ads and 60 seconds duration per pod brings substantially higher drop-off risk as viewers disengage.

In fact, analysis found drop-offs occurring during the content itself before ads even run. This indicates break frequency and length directly reduces retention regardless of ad quality. Striking the right balance poses a core difficulty for smaller OTT publishers.

Perspective on the Tensions Facing Local Providers

As a smaller streaming provider ourselves focused on the Latvian market, we certainly recognize the tensions around maximizing subscriptions and ad revenues versus keeping audiences happily engaged.

With a limited local population size, we cannot rival the lighter ad loads major global platforms offer. But stretching frequency and duration too far risks losing viewers to competing services offering a smoother experience.

Advanced targeting and innovations like branded content are potential solutions. But the core challenge remains balancing monetization with an optimal, non-intrusive ad load. How smaller niche providers solve this equation will determine their viability and competitiveness.

Best Practices for Optimizing Premium Video Ad Loads

Research on ideal frequency and length to maximize retention provides guidance:

- YouTube caps pre-roll ads at 15-30 seconds as best practice

- Engagement steeply declines beyond six minutes of ads per hour

- Major providers average two to three minutes of ads hourly

So minimizing ad load improves retention, but smaller publishers must innovate to generate revenues without excessive overload:

- Experiment with innovative experiences like branded content and sponsorships

- Leverage first-party data to focus ads to the most engaged users

- Test frequency caps to limit overexposure among different segments

- Promote upgraded ad-free subscriptions to give users control

The risks of overloading ad breaks are clear, but videos don’t monetize themselves. OTT providers must continually balance generating critical revenues against retaining satisfied audiences.

Conclusion

Premium video publishers face constant tensions optimizing ad loads for monetization goals versus subscriber experience. While leaders can minimize quantities, smaller niche providers require creative solutions to generate needed revenues without disengaging ad bombardment. Given high consumer sensitivity, striking the right equilibrium is imperative but challenging.