In an era of rapidly evolving media consumption habits, YouTube’s increasing presence on television screens is reshaping the landscape of video content. The latest Ofcom Media Nations report for 2024 highlights a significant shift in how audiences, particularly in the UK, are engaging with YouTube through their TV sets. This trend has far-reaching implications for advertisers, broadcasters, and the future of television itself.

Key Findings from the UK

- YouTube on the Big Screen: According to Ofcom, 34% of YouTube’s viewing inside UK homes now occurs on TV screens, up from 29% the previous year.

- Decline of Linear TV: Broadcast TV continues its long-term decline, though the rate of decline has slowed across most age groups.

- Gen Z Viewing Habits: Among 16-24 year-olds, linear TV viewing declined by 16% in 2023, compared to a 26% drop in 2022.

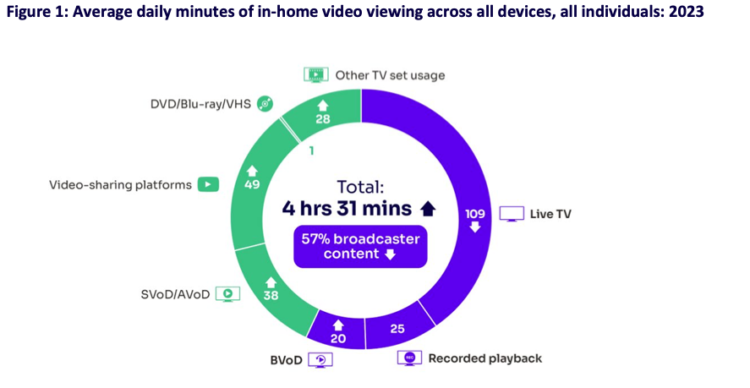

- Overall Video Consumption Increase: Total video viewing time increased by 2%, reaching an average of 4 hours and 31 minutes per day for individuals aged four and above.

Global Comparisons

United States

The trend of YouTube’s growing presence on TV screens is not unique to the UK. In the United States, similar patterns are emerging:

- According to Nielsen’s State of Play report, YouTube reached over 135 million people on TV screens in the US in December 2023.

- Comscore data shows that YouTube accounts for 24% of all streaming watch time on connected TV devices in the US.

Europe

European countries are also experiencing shifts in video consumption habits:

- In Germany, a study by ARD/ZDF found that 25% of 14-29 year-olds use YouTube daily on TV screens.

- France’s CSA reports that 22% of French internet users watch YouTube on their TV sets at least once a week.

Implications for Advertisers and Broadcasters

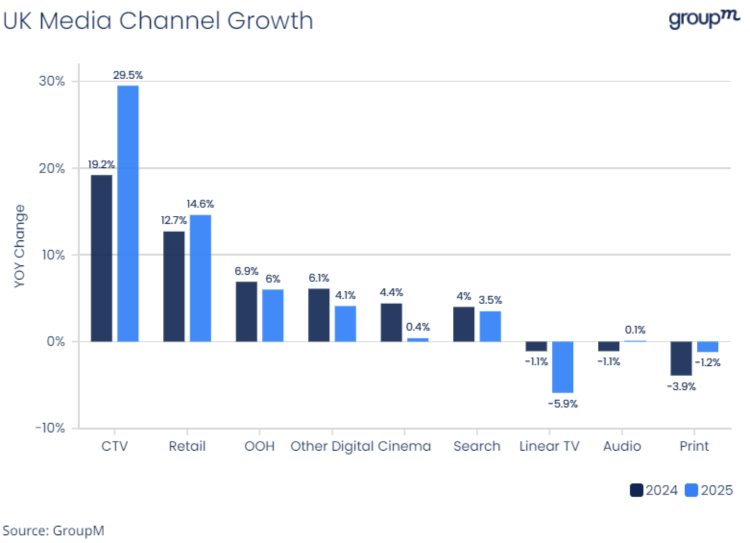

- Budget Shifts: As audience behaviors change, advertising budgets are following suit. GroupM predicts that “connected TV” (including YouTube and BVOD) will grow by 19% in 2024 and 30% in 2025 in the UK.

- Measurement Challenges: Current measurement systems, such as Barb in the UK, don’t capture out-of-home or mobile viewing, potentially underestimating YouTube’s total reach.

- Content Quality and Regulation: While YouTube offers a vast array of content, questions remain about how it compares to professionally produced, regulated broadcast content in terms of advertiser appeal.

- Ad Effectiveness: Factors like default sound-on settings and non-skippable ads on YouTube can impact ad effectiveness compared to traditional TV or other digital platforms.

The Future of TV and Video Consumption

As YouTube continues to gain traction on TV screens, several questions arise about the future of television:

- Content Convergence: Will we see more convergence between traditional TV content and YouTube-style content?

- Regulatory Changes: How will regulators adapt to the blurring lines between traditional broadcasting and online video platforms?

- Measurement Evolution: Will new measurement systems emerge to capture the full spectrum of video consumption across all devices and locations?

- Advertiser Strategies: How will advertisers balance their spending between traditional TV, BVOD, and platforms like YouTube to maximize reach and effectiveness?

Conclusion

YouTube’s growing influence on TV screens represents a significant shift in the media landscape. As viewing habits continue to evolve, broadcasters, advertisers, and regulators will need to adapt to this new reality. The future of television is likely to be a hybrid model, blending traditional broadcasting with the flexibility and diversity of online video platforms.

For marketers and media planners, understanding these trends is crucial for developing effective strategies that reach audiences across all screens and platforms. As the lines between different forms of video content continue to blur, the ability to create cohesive, cross-platform campaigns will become increasingly important.

Sources:

- Ofcom Media Nations Report 2024

- Nielsen State of Play Report 2024

- Comscore Connected TV Report 2024

- ARD/ZDF Online Study 2023 (Germany)

- CSA Digital Media Usage Report 2023 (France)

- GroupM Global Mid-Year Forecast 2024

- Advertising Association/WARC Expenditure Report 2024

- Thinkbox TV Viewing Report 2024