In the ever-evolving landscape of streaming media, understanding viewer preferences and ad experiences is crucial for both platforms and advertisers. A recent study by MX8 Labs sheds light on consumer perceptions of ads across various streaming services, revealing some surprising insights that could shape the future of digital advertising.

Key Findings: Netflix Leads, But YouTube Wins in Ad Experience

The MX8 Labs survey uncovered a mix of expected and surprising results:

- Streaming Giants Dominate: Netflix maintains its crown as the most-watched service across all demographics, followed by YouTube and Amazon Prime Video.

- Ad Length Perception: Contrary to popular belief, most viewers find current ad break lengths “about right” on most platforms. The notable exception? YouTube, where ads are perceived as “too long.”

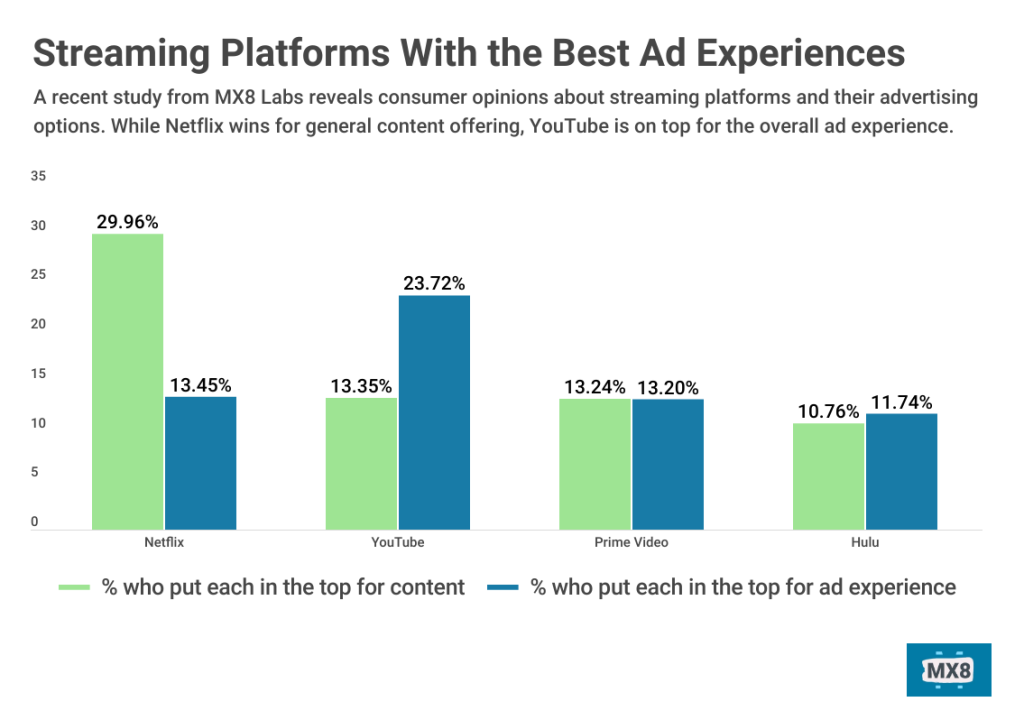

- Best Overall Content: Netflix leads with 29% of viewers ranking it highest, followed by YouTube (13.4%) and Prime Video (13.2%).

- Superior Ad Experiences: YouTube takes the lead in ad experience quality, with 23.7% of respondents rating it best. Netflix and Prime Video are in a tight race for second place, at 13.5% and 13.2% respectively.

- Ad-Supported vs. Ad-Free: While over half of Netflix and Disney+ subscribers opt for ad-free tiers, other major platforms see more than 50% of users choosing ad-supported options.

- Ad Relevance: Top-ranked streamers are noted for more relevant ads, while platforms like Peacock and the Roku Channel face criticism for less relevant and excessive advertising.

Addressable TV: The Future of Targeted Advertising

Addressable TV represents a significant shift in how ads are delivered on linear television. Unlike traditional broadcast advertising, Addressable TV allows for the replacement of entire ad breaks with targeted content based on viewer demographics and interests.

According to a report by Deloitte, the Addressable TV market is expected to reach $7.5 billion by 2025, highlighting its growing importance in the advertising ecosystem. This technology bridges the gap between traditional TV advertising and the personalized approach of digital platforms, offering more relevant ads to viewers and potentially increasing engagement rates.

The Rise of FAST Channels

Free Ad-Supported Streaming TV (FAST) channels have gained significant traction in recent years. These channels offer viewers free content in exchange for watching ads, similar to traditional linear TV but delivered over the internet.

A study by nScreenMedia predicts that FAST channels will generate $4.1 billion in ad revenue by 2023, indicating a growing appetite for this hybrid model of streaming and traditional TV advertising.

Optimal Ad Break Duration: Finding the Sweet Spot

The ideal length for ad breaks remains a topic of debate in the industry. However, recent research provides some insights:

- A study by ThinkBox suggests that ad breaks between 2 and 3.5 minutes are most effective, balancing viewer tolerance with advertiser needs.

- Hulu’s internal research, as reported by Digiday, found that ad breaks of 90 seconds or less resulted in higher brand recall and viewer satisfaction.

It’s crucial to note that optimal ad break duration can vary depending on the platform, content type, and viewer demographics. Streaming services continue to experiment with different ad formats and durations to find the right balance.

Conclusion: Adapting to Viewer Preferences

As the streaming landscape continues to evolve, platforms and advertisers must remain agile, adapting their strategies to meet viewer preferences. The insights from the MX8 Labs study, combined with industry trends in Addressable TV and FAST channels, highlight the importance of delivering relevant, well-timed ads across all streaming formats.

By focusing on creating positive ad experiences and leveraging new technologies, streaming platforms can maintain viewer engagement while maximizing advertising effectiveness in this dynamic digital ecosystem.

Sources:

- MX8 Labs Consumer Study (2024)

- Deloitte Addressable TV Market Report (2023)

- nScreenMedia FAST Channel Revenue Forecast (2022)

- ThinkBox Ad Break Duration Study (2023)

- Digiday report on Hulu’s Ad Research (2023)