YouTube’s connected TV ad impressions have surged to account for 40% of its US total, up from just 12% two years ago per The Information. This shift demonstrates YouTube’s escalating competition with linear TV for ad budgets. We examine the implications of YouTube’s booming CTV business and opportunities for local streaming platforms.

Key Highlights:

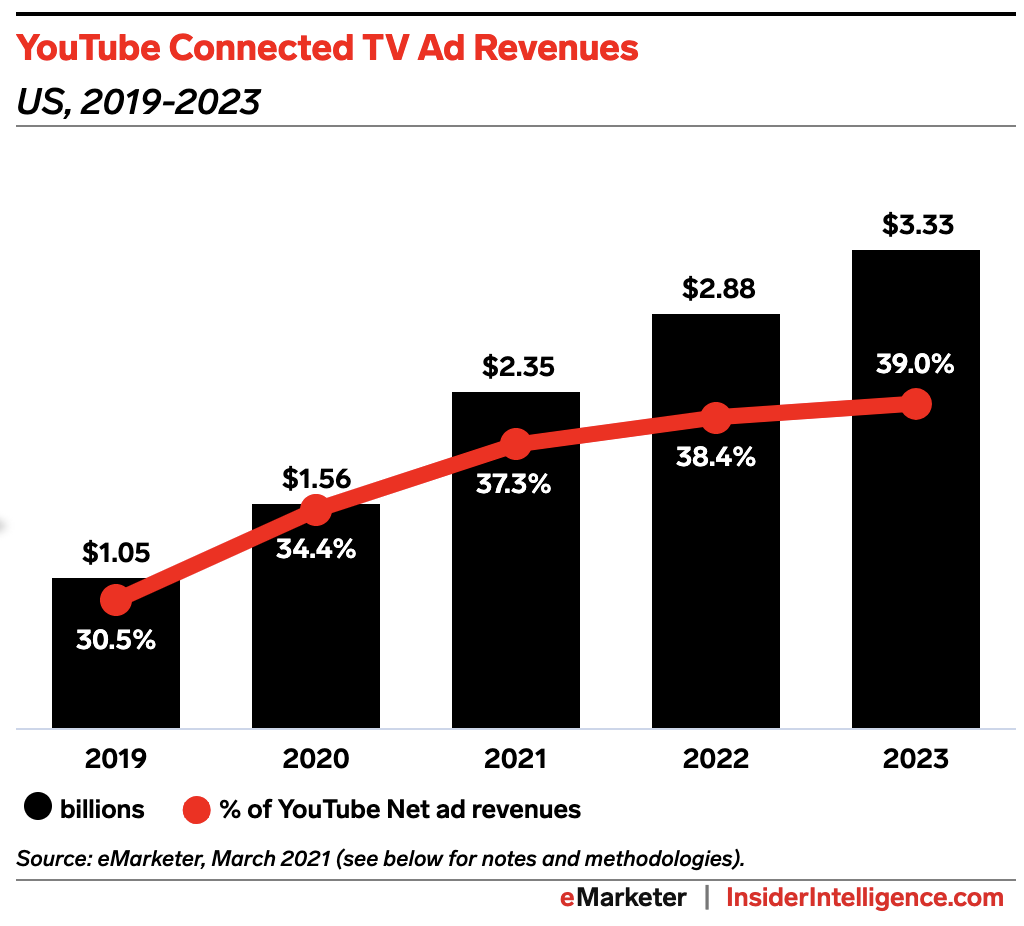

- YouTube’s CTV ad revenues could hit $2.35 billion in the US alone this year

- TV viewing drives increased share of YouTube’s impressions and revenues

- But content and brand safety concerns still hinder bigger TV budget shifts

- Small local platforms could generate unique UGC to complement premium content

- Ad revenues, subscriptions, and sponsorships provide UGC monetization

YouTube’s Rising Prominence as a TV Advertising Rival

YouTube’s US CTV ad revenues are forecasted to account for 37% of its total, reaching $2.35 billion this year. The dramatic shift of viewing to TV screens, accelerated by the pandemic, has fueled growth.

With impressions following eyeballs, YouTube has become a major CTV ad player vying directly with linear TV. As CTV usage increases and traditional TV declines, more TV budgets will likely shift.

But many big advertisers still have concerns around YouTube’s content quality and brand safety versus television. As premium streamers like HBO Max enhance their ad offerings, they may siphon budgets away from YouTube.

Opportunities for Local Platforms in User Generated Content

For smaller, local streaming platforms like Go3, user generated content (UGC) represents an untapped opportunity. While premium shows and movies drive at-home viewing, UGC provides entertaining bite-sized content for mobile.

Exclusive UGC from existing creators could differentiate local platforms. Branded content would drive awareness. And a steady stream of new UGC may arise in small but passionate markets.

Monetization models like ad revenues, subscriptions for creator content, and sponsorships for product placement could incentivize UGC production.

UGC provides a more interactive, community-driven dimension that appeals to younger generations. Paired with polished premium programming, it can make local platforms more engaging across screens and dayparts.

The Evolving Viewing Landscape Fueling YouTube’s Rise

YouTube’s rapid expansion into CTV advertising is fueled by shifts in consumption patterns. As linear TV declines accelerate, YouTube gains screen time on the world’s most influential advertising medium.

According to eMarketer, US adults will spend 29% of total daily video time watching linear TV in 2023, down from 33% in 2020. But time spent watching internet video will rise from 66% to 70% during that period.

Within this expanding internet video universe, YouTube rules. Data from Comscore shows YouTube garnered over 40% of time spent streaming in the US as of Dec 2021. The next closest competitor was Hulu at just 8.8% share of streaming minutes.

As the go-to destination for video, YouTube is positioned to keep capturing traditional TV audiences and marketing dollars. Its array of professional and user-created content caters to shifting viewer preferences.

YouTube’s Major Growth in CTV Ad Revenues

Reflecting viewership gains, YouTube’s CTV ad revenues have charted major expansion.

According to eMarketer estimates, YouTube will generate $2.35 billion in US CTV ad revenues in 2023. This accounts for over 37% of its total US ad revenues.

And YouTube already extended its lead as the top CTV ad platform last year. Its 2022 US CTV revenues topped $1.7 billion compared to around $1 billion for Roku, its next biggest competitor according to eMarketer.

As the platform most consumers turn to for video, YouTube is gaining share of the expanding CTV advertising market. Its revenues demonstrate a dramatic shift of ad investments following engaged viewers.

Key Concerns Slowing YouTube’s Capture of TV Budgets

But YouTube faces obstacles in unlocking TV ad budgets to match its growing footprint. The two primary barriers are content and brand safety.

Many TV advertisers perceive YouTube’s user-generated content library as inferior for premium branding compared to high-quality professional productions. Unpredictable UGC also raises brand safety concerns.

In contrast, major ad-supported streamers like Hulu offer more consistent quality and context for brands. Measurement and targeting capabilities provide further incentives for advertisers to shift budgets.

However, as YouTube viewership keeps rising while linear TV declines, it may become harder for brands to justify bypassing the platform. YouTube provides unmatched scale and powerful targeting data advertisers will find difficult to ignore.

Conclusion

YouTube’s booming connected TV advertising business signals a growing competitive threat to traditional television. While hurdles remain, YouTube is positioned to capture greater portions of TV budgets as viewing patterns evolve. Meanwhile, local streaming players can unlock unique opportunities by embracing user generated content.

Ultimately, consumer attention dictates advertising dollars. As YouTube keeps expanding its share of streaming minutes, expect its CTV ad revenues to follow accordingly.